By October 1, 2015, most banks and other credit card providers had provided their cardholders with the new EMV chip cards. Merchants had until this same date to transition their POS systems to those with the capacity to read these EMV chip cards.

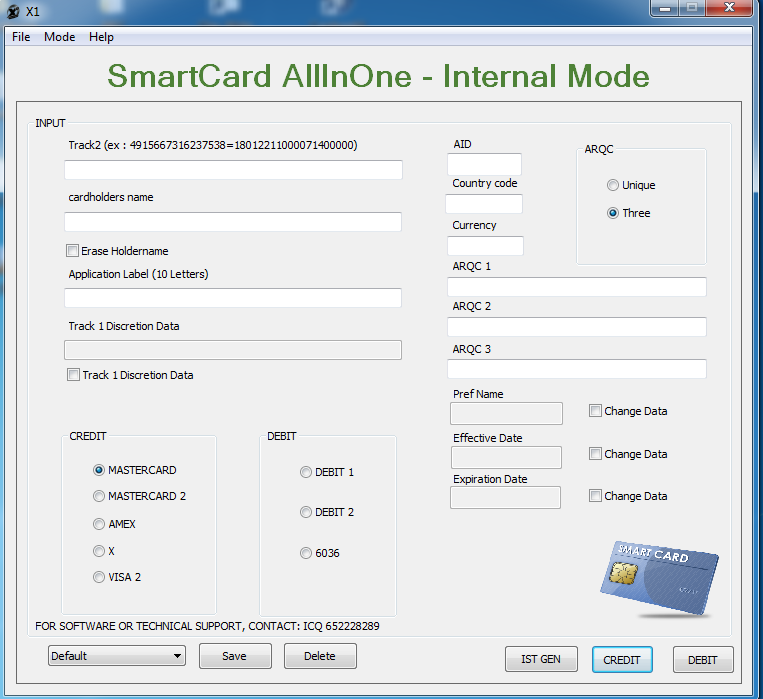

Scroll down the Functions list and locate uemvcfg - Update EMV Configuration and uemvinit - Update EMV Initialization. Click the checkboxes to activate the uemvcfg and uemvinit functions. Scroll down the Functions list and locate vemvcfg - View EMV Configuration and vemvinit - View EMV Initialization. EMV Level 1 and Level 2 Software. Add EMV Level 1 functionality to embedded systems. Read more + EMV Kernel for Windows. EMV Chip Card Update. EMV® is a global standard for credit and debit payment cards based on chip card technology, taking its name from the card associations Europay, MasterCard, and Visa – the original developeds. Software Architecture & Windows Desktop Projects for $3000 - $5000. I need software updated that can be used to read and write emv chip, as well as edit emv chip data.With arqc dynamic support to create arqc cetificate and cryptogram that comes with algos.I want to du.

ATMs represent the final step in this shift.

Get Free ATM Machine Quotes

The Liability Shift, Credit Card Machines

The intention of this change was improved protection against credit card fraud. Merchants had no legal requirement to make the change, but they did have incentive in the form of fraud protection.

In the past, credit and debit card providers assumed financial responsibility for fraudulent transactions made with the magnetic stripe cards. If the card provider failed to provide chipped cards by the deadline, they remain responsible for fraudulent activity. However, with implementation of the EMV chip cards, businesses that fail to install compatible credit card machines assume that responsibility.

In the event both parties – the card issuer and the merchant – took equal steps toward security, previous liability applies (meaning that the banks assume responsibility).

The Liability Shift, ATMs

The deadline to upgrade ATMs to read EMV chip cards varies by card provider. For MasterCard, the deadline is October 1, 2016, while Visa's deadline is October 1, 2017. As with merchant liability for those failing to upgrade credit card machines, liability for fraudulent transactions shifts to the entity failing to make the EMV switch.

Consumers (people who use ATMs) will likely find fewer ATMs, as smaller operators may choose to pull their machines rather than make the change. They'll also discover changes in how they use the new machines, with different on-screen menus and prompts.

Though the deadlines for upgrading machines are staggered, most ATM owners will perform both upgrades simultaneously as a way to keep transition costs down.

Making the Upgrade

For ADA-compliant ATMs, upgrading requires software and a Level 1 EMV-certified card reader. An upgrade kit consisting of the card reader, bezel, mounting hardware, and various parts averages between $200 and $300.

However, actual costs come in about 10 times that amount, averaging between $2,000 and $4,000. This takes into account the software changes the EMV upgrade requires. The costs seem high, but when you factor in the cost of not performing the upgrade, and therefore assuming fraud liability, the cost is minor.

ATM operators that fail to make the upgrade eat the cost of fraud committed by criminals using counterfeit, magnetic stripe cards. Countries that completed this upgrade years ago, such as those in the European Union and Canada, experienced these issues. At that time, criminals using counterfeit credit and debit cards began targeting smaller ATM providers, such as those located in convenience stores and not anchored to a banking institution.

The Bottom Line

ATM owners must decide whether the cost of the upgrade is one they can absorb. If not, they must then decide whether the risk of fraud is worth remaining in business. The result may be a decision to close those ATM machines receiving less business, while making the upgrade to those receiving the highest levels of use.

Card Issuance

HST has been providing EMV solutions and supporting banks and financial institutions with card issuance throughout the Americas for almost 2 decades.

Whether you are a financial or retail institution looking to offer instant card issuance to your customers or you are a bureau looking for a multi-vendor centralized issuance solution, HST has the right solution and the right team to get you started on the right foot.

On a monthly basis, we issue close to 1 million cards with our Instant Issuance solution throughout the region, which are delivered either in branches or retail outlets.

Our highly secure solutions follow payment industry standards and are PCI PCC and EMV compliant in addition to complying with brand security requirements.

We offer multiple implementation and pricing options for all size budgets and institutions.

OUR SOLUTIONS

INSTANT ISSUANCE SOLUTIONS

HST offers 2 options for EMV instant card issuance: a cloud based solution for all budgets and sizes of institutions and a fully customizable, local solution running on your own infrastructure.

We offer a turn key EMV instant issue solution providing everything you need to print EMV cards instantly:

- Personalization software

- Plastic EMV cards

- Service & maintenance packages

- Delivery options for all size institutions & budgets

- Security

- Personalized card design options

- Locally installed or cloud options

CENTRAL ISSUANCE SOLUTION

Central Issuance is a key part of a balanced, card issuance strategy. Ideally, a financial institution would take a dual approach to card issuance; centrally issued cards for large batch issues complemented by instantly issued cards at the branch for new accounts or replacements.

HST’s Central Issuance Solution provides a number of important benefits that allow users to preserve their investment and plan their growth strategy:

- By allowing clients to determine their architecture scheme, they can effectively pace their growth as well as distribute their work load.

- Our solution accommodates most brands, printer models and has full profile support

- Technology support for contact/contactless/dual interface

OTHER SOLUTIONS

EMV CARD APPLICATION

HST provides custom Smart Card applications to fit customers’ requirements. Our software can assist you with any step in the Smart Card development cycle such as requirements, specifications, design coding and testing.

HST Card Application is designed for issuers who want to migrate Private Label Card Application to Smart Card using EMV standards. (EMV Loyalty Programs, Electronic Purse Applications, retail cards, closed loop transactions)

Emv Software Code

EMV TRANSACTION PROCESSOR

Update..emv Software Download

EMV Transaction Processor is designed to reduce fraud; it is for Issuers needing to authenticate cryptograms or generate scripts for their EMV cards. The system provides chip data authentication and enhances fraud prevention processes. HST Transaction Processor provides card issuers with the ability to dynamically update EMV parameters on Smart Cards after issuance. The solution also allows customer PIN change. Issuers can enable their cardholders to select, change and unblock their PINs quickly and easily at any branch or self-service terminal.

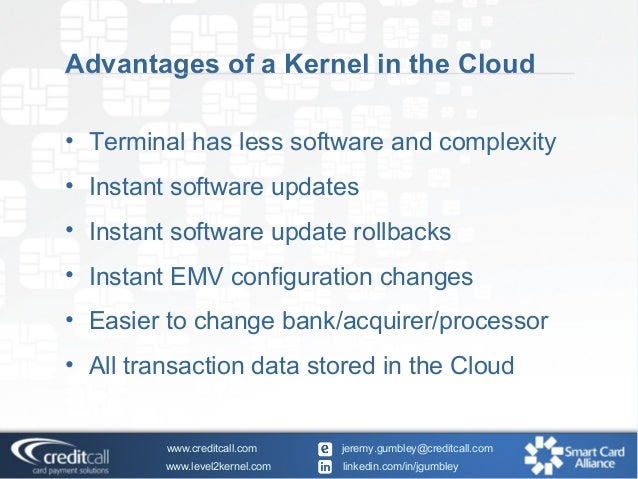

EMV KERNEL

EMV kernel software interfaces with a terminal, ATM or POS device and enables it to process EMV transactions. HST’s EMV Kernel is EMVCo Level 2 certified and is designed to integrate easily with terminal hardware (reader and driver) and the application. Our solution is designed to run on ATM’s, Branch Terminals, Pinpads, Kiosks or other options. HST has over 80,000 kernels deployed in top financial institutions.

Update..emv Software Windows 10

HST can provide support for contact or contactless cards. Ready for Windows, Linux and Android platforms the kernel is multivendor.

DOWNLOAD

ONE OF OUR

BROCHURES

Emv Software X2 Free